How does VAT work

VAT is a consumption tax applied at every stage of the supply chain where value is added, from production to the point of sale. The final consumer ultimately bears the tax. VAT is common in most countries worldwide, particularly in Europe and some parts of Asia and Africa. VAT rates vary by country and are often categorized into standard, reduced, and zero rates for different goods and services.In the EU

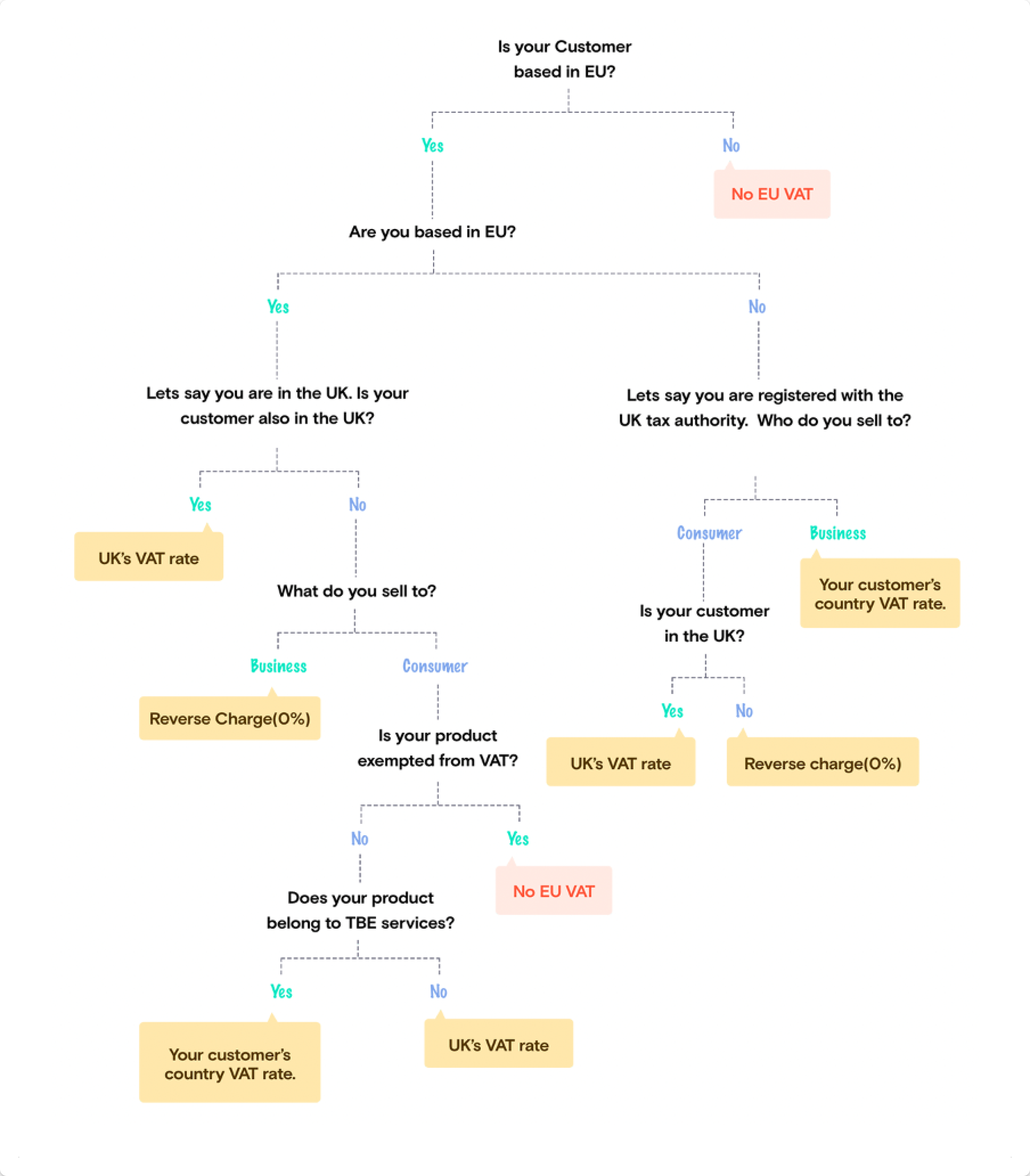

First and foremost, ensure that you’re registered with your country’s tax authority and hold a valid VAT registration number, also known as an EU VAT Identification number. This number will be essential for conducting VAT-related activities. Next, it’s crucial to determine whether your customers are businesses or consumers. Hyperline will verify VAT numbers for you so you can make sure to only manage legally registered businesses. Here’s a flow chart representing how VAT should be applied (and how Hyperline works under the hood).

Outside the EU

If you’re a business registered within a EU-based country, you don’t charge VAT for customers that are based outside of the EU. Please take a look at this page to learn more about the different VAT rates globally.How does Sales Tax work

Sales tax is a tax imposed on the sale of goods and services, collected only at the point of sale from the end consumer. It is primarily used in the United States and some parts of Canada, and rates are usually set by states or local governments and vary significantly across jurisdictions.Taxes in Hyperline

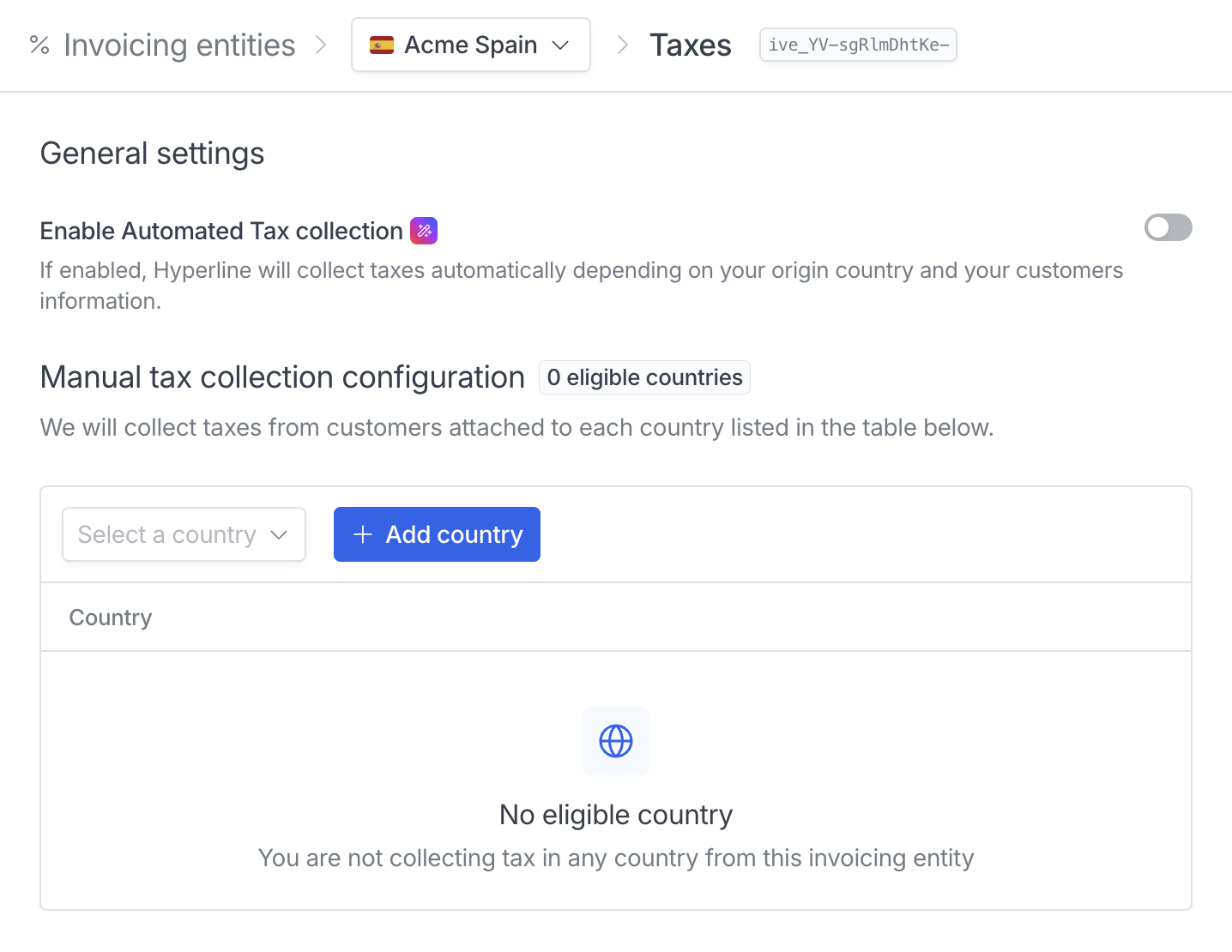

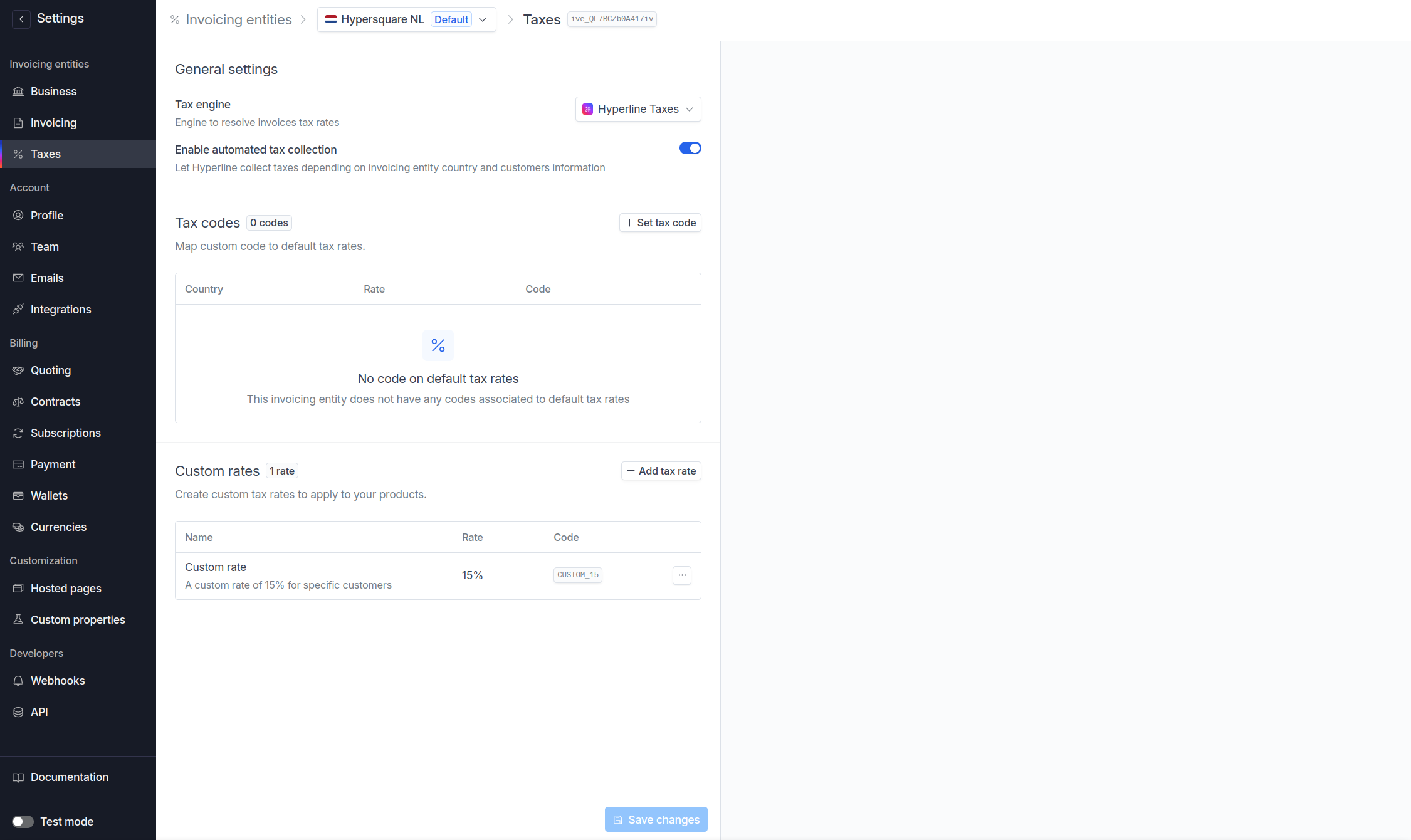

In Hyperline, tax settings are managed per invoicing entities, allowing you flexibility in defining specific tax behavior depending on the legal entity responsible for issuing customer invoices. Hyperline automatically resolves the right tax scheme and applies tax standard rate, the default rate of taxation applied to most goods and services. This is the general rate set by the government, which applies unless a specific good or service qualifies for a reduced rate, zero rate, or exemption. Two options are available regarding VAT collection:- Automated tax collection: Hyperline will automatically collect taxes based on your origin country and customer information (country, VAT number, etc). The correct VAT amount and rate will be applied on the issued invoices.

- Manual tax handling: Hyperline allows manual tax handling where you are responsible for filling taxes by country.

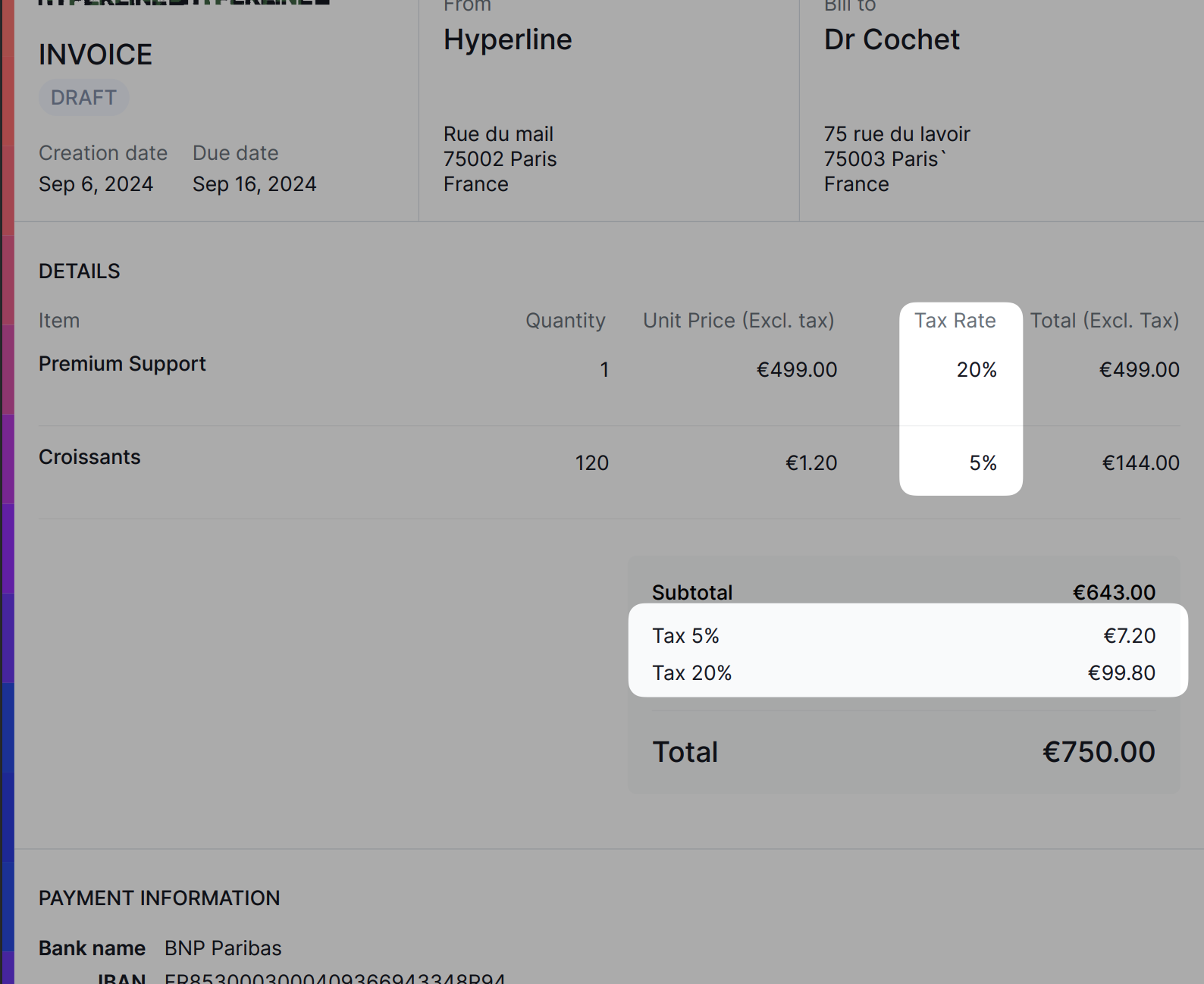

Tax on invoices

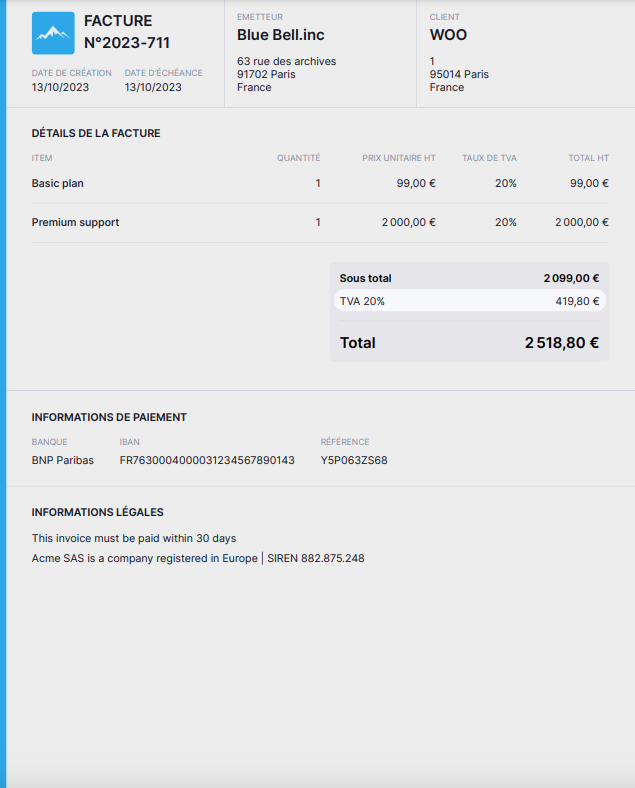

The taxes (rates and amounts) will appear on all invoices under the billed subtotal.

Tax per customer

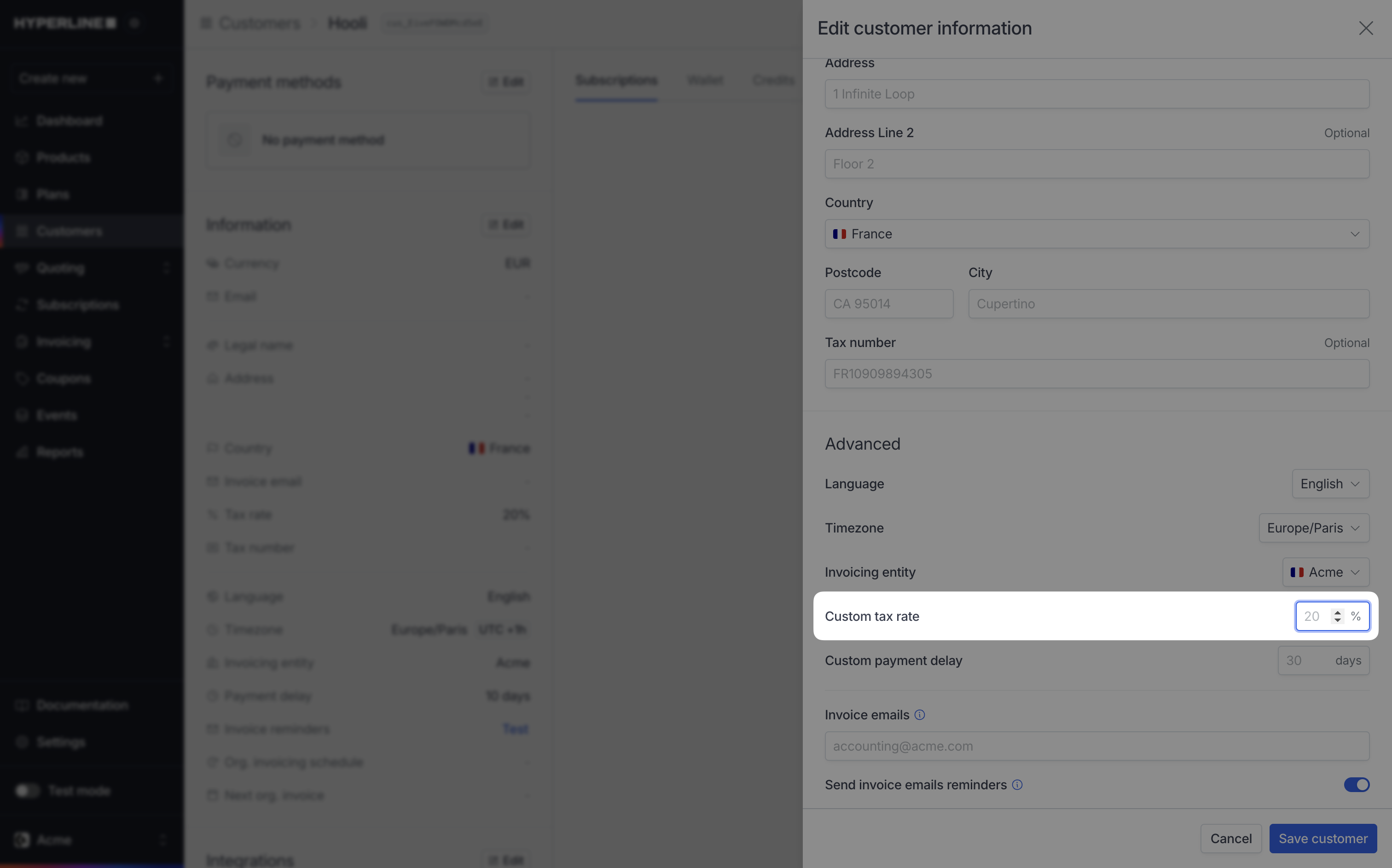

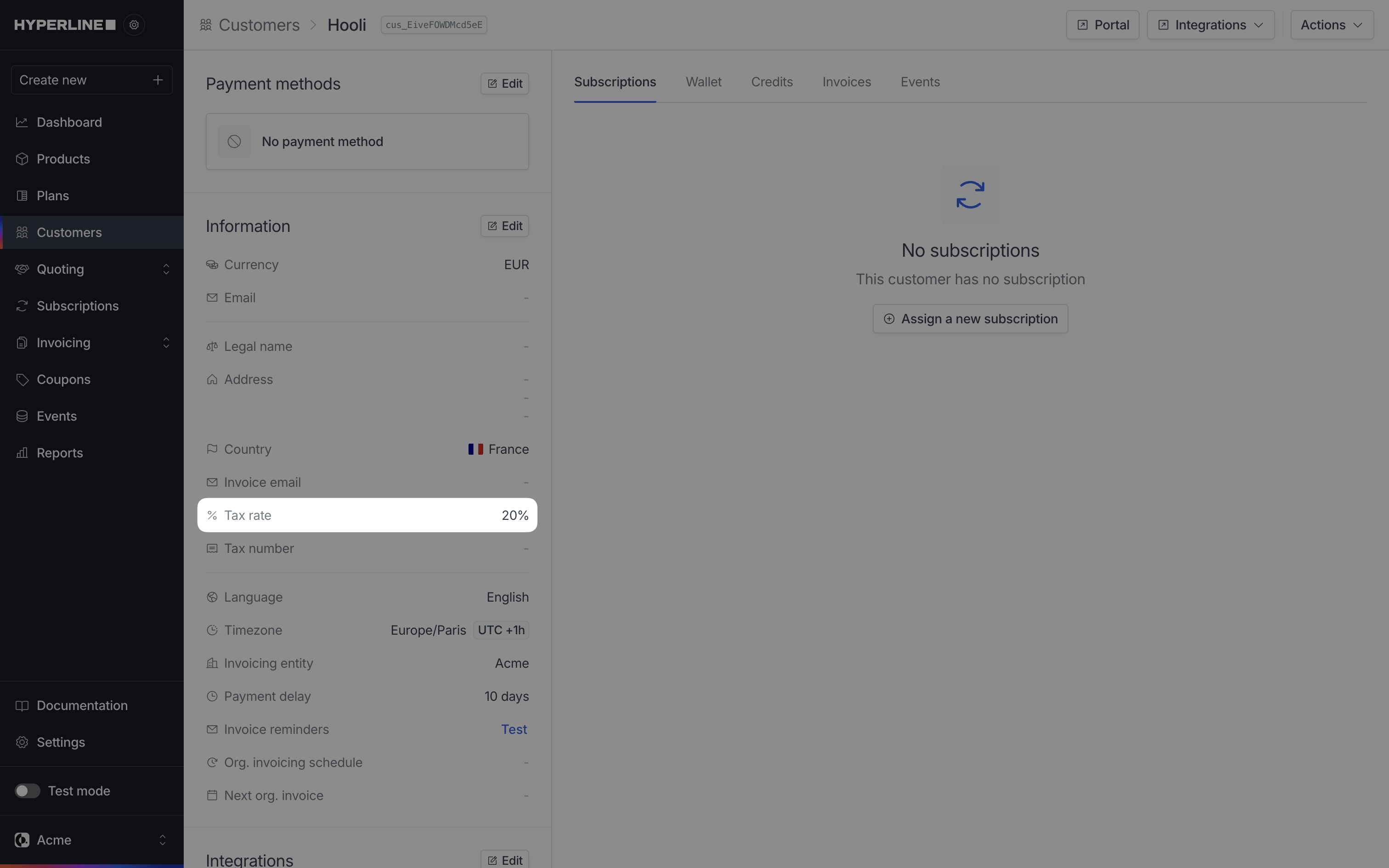

You can customize the tax rate per customer if necessary, but be careful, a manual tax rate set on a customer will not allow Hyperline to display any legal information associated to that rate in the invoice. You can add a custom invoice note for the customer to fix this.

Customize tax rate per customer

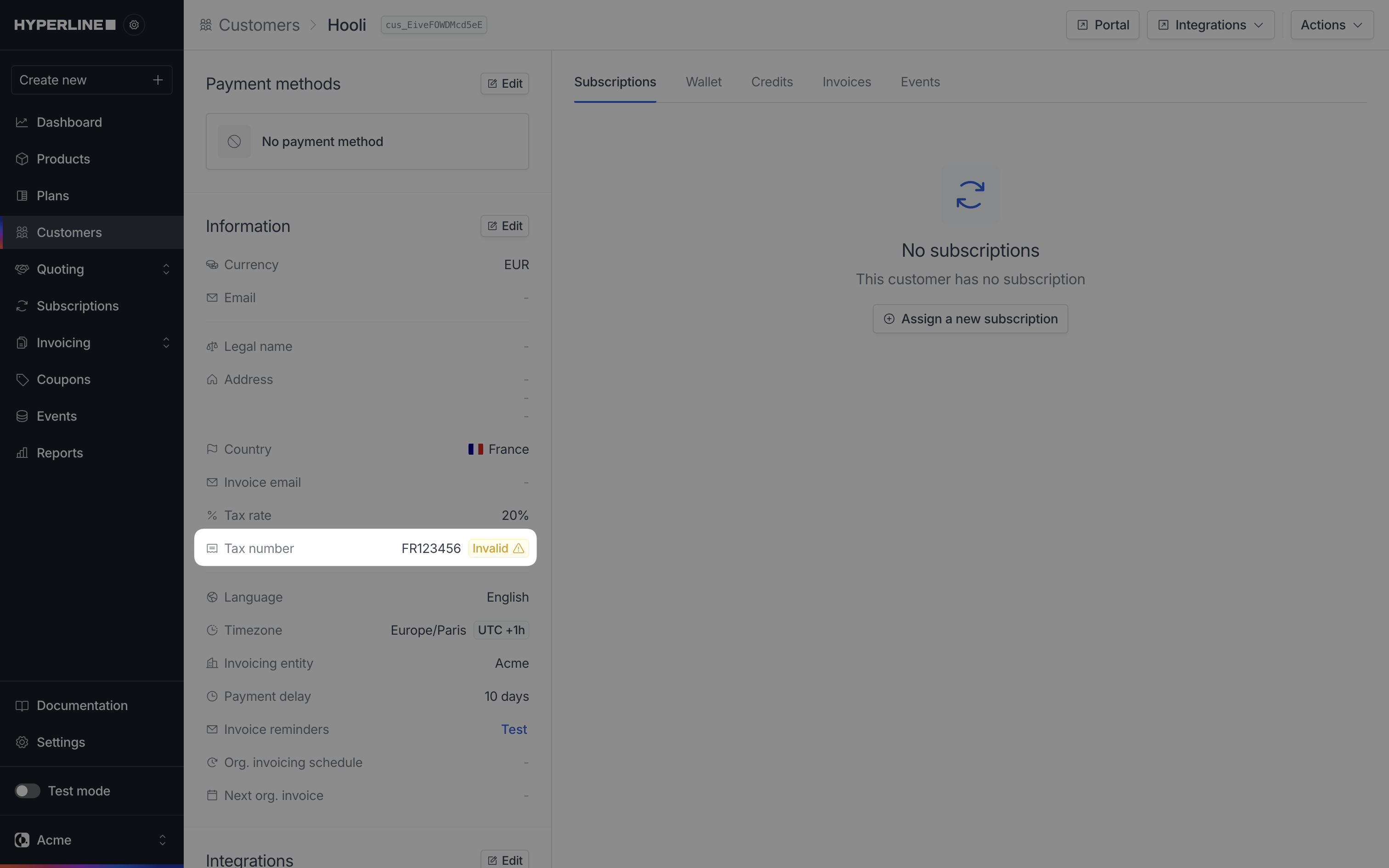

VAT in the EU

Hyperline automatically manages VAT in the EU - but a customer will only get a reverse charge rate (so a 0% rate) if the tax number is filled on their profile. You can do it yourself or have them do it from their portal / checkout flow.Checking for invalid VAT numbers

While we are verifying the VAT number’s validity and displaying it in your interface, we’re trusting your customer as long as the format of the VAT number is valid. VAT databases are not always up-to-date and Hyperline cannot always confirm a specific number belongs to a specific customer.

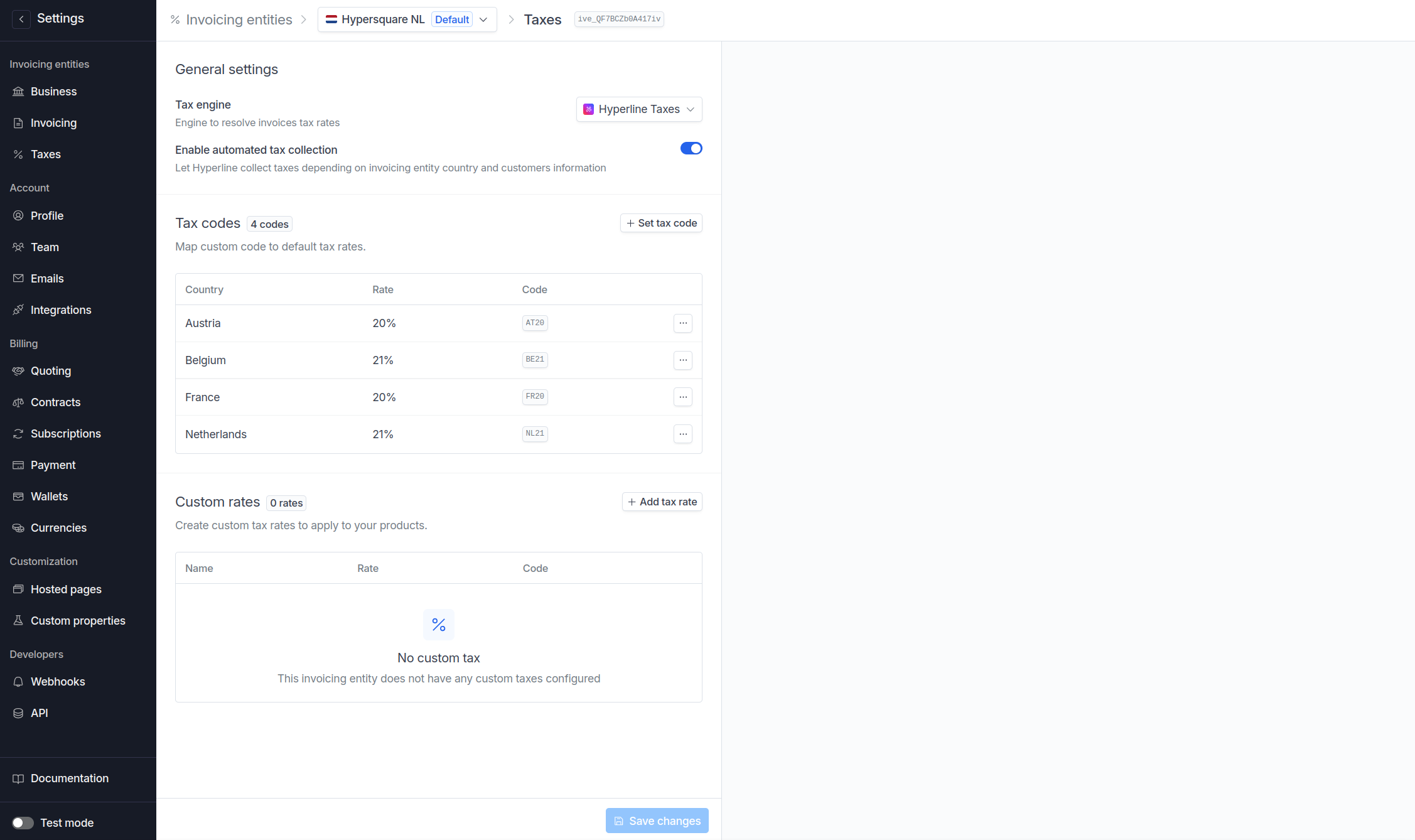

Default tax rates

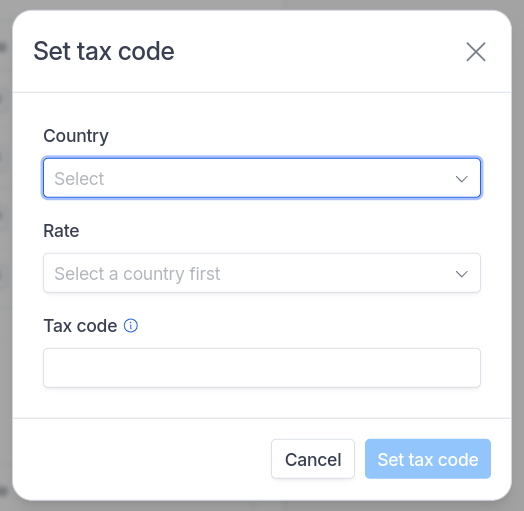

When using Hyperline’s automatic tax collection feature, you can define codes for the default tax rates so that they match the codes in your accounting software.

Assign code to default tax rates

If you have an accounting software connected to Hyperline, the tax codes will be automatically linked to the item lines, before pushing the invoice to your accounting software.

Custom tax rates

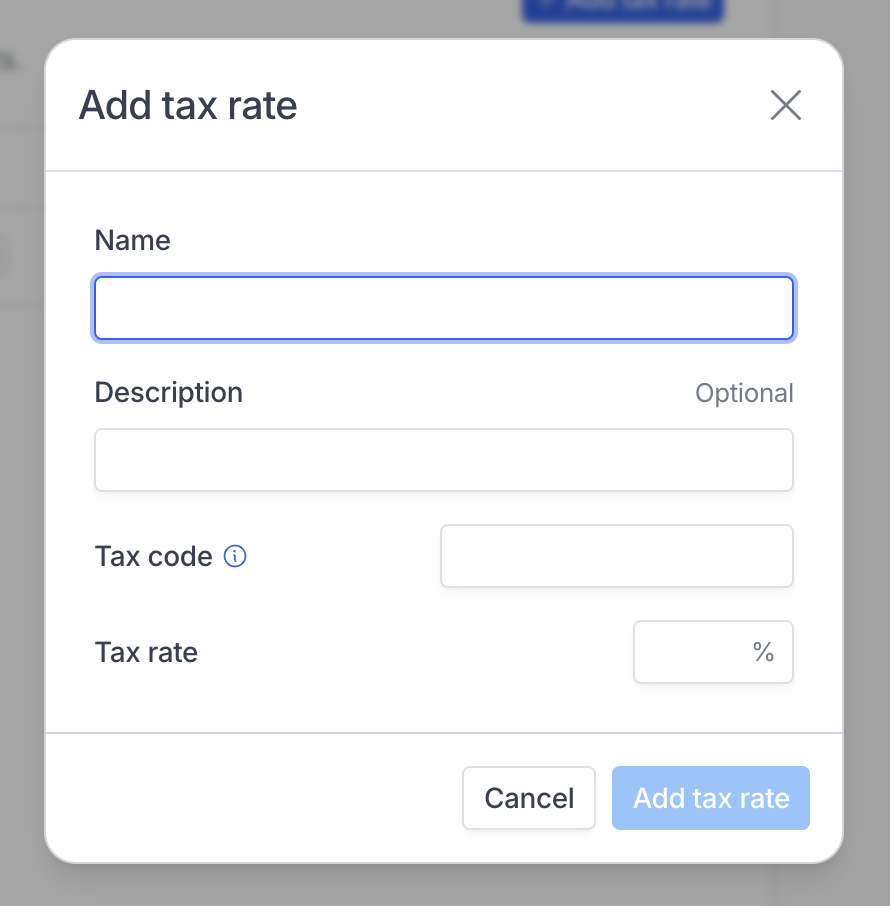

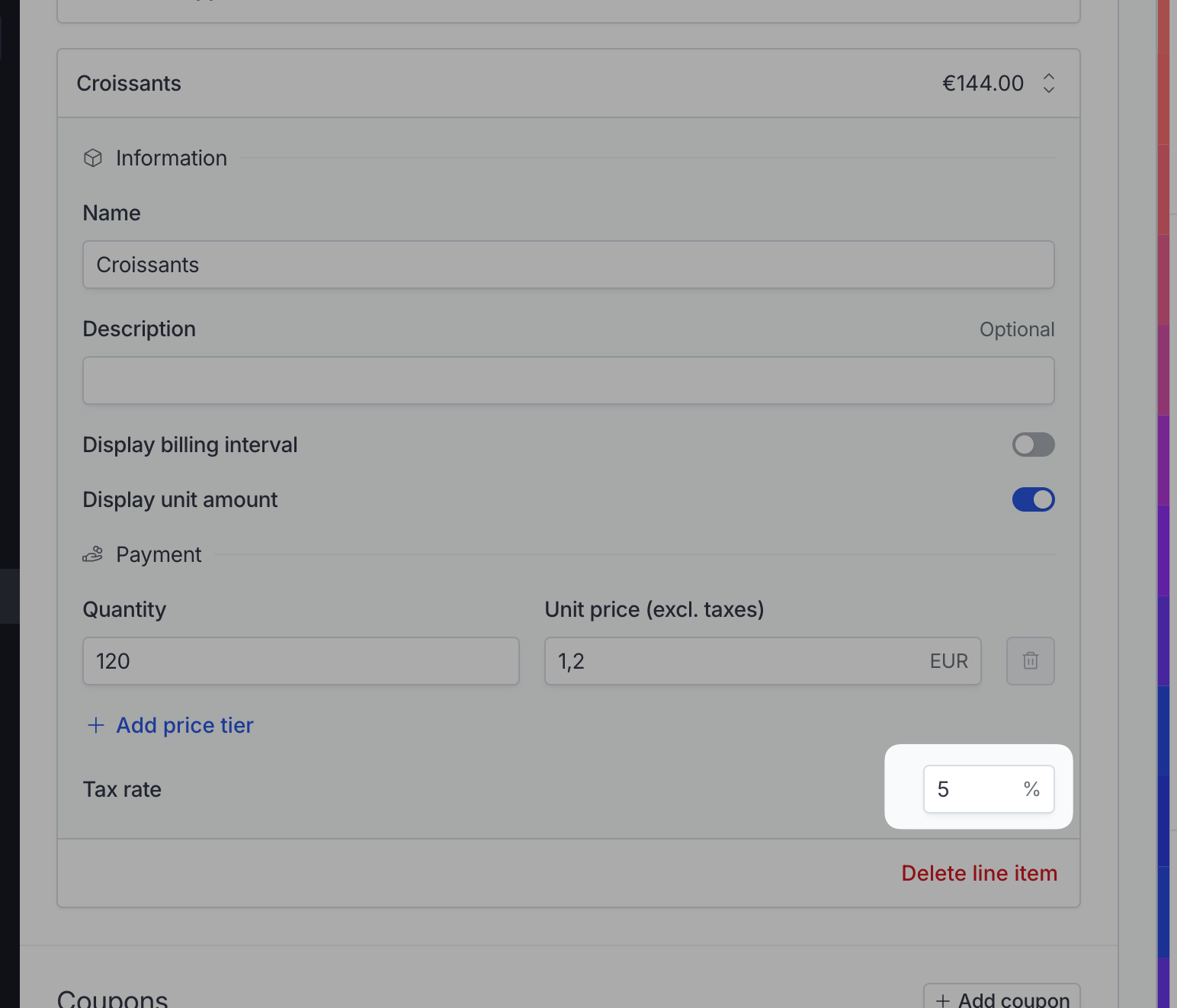

While a country’s standard tax rates are used by default in Hyperline’s tax rate logic, you can also customize specific tax rates to suit your needs, which don’t have to match the general standard rates.

Create reusable custom tax rate

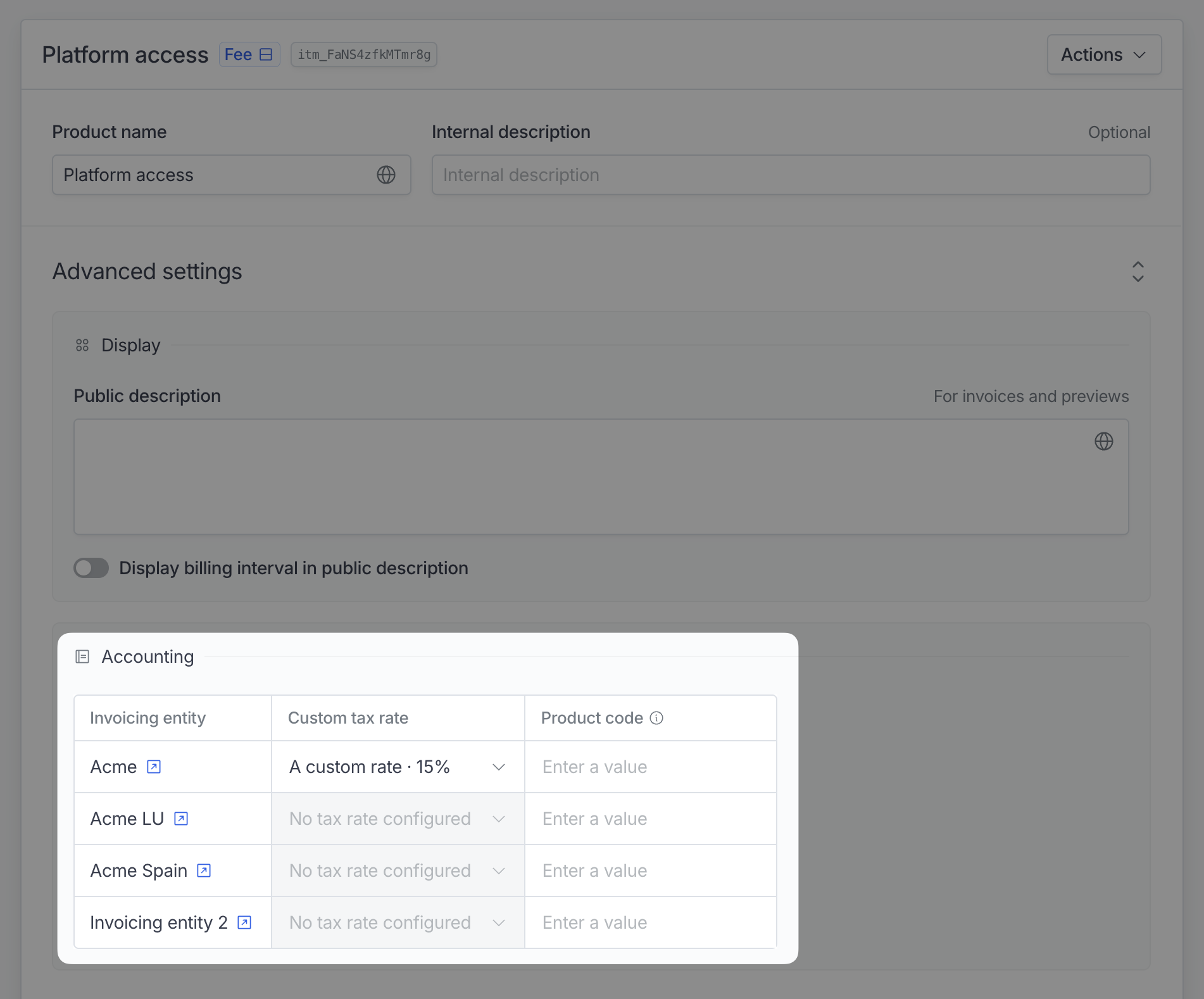

The custom tax rates can later be assigned to products in your catalog, allowing for precise control over which rate applies to each product, depending on the invoicing entity.