Book a call with our team

Still wondering if building your own billing system is a good idea? Let’s talk about it - we are here to answer all your questions.

Subscription and usage-based models

Launching a billing system typically begins with subscription-based billing. In this approach, each customer is assigned to a specific plan to ensure accurate charges at the right interval. The fact is that complex pricing models are at the core of modern business operations. As your company grows, you will likely implement various pricing strategies to optimize revenue and cater to client needs. This growth may entail the adoption of usage-based pricing, transactions, credits, custom subscriptions, coupons, or a mix of these items. Managing a large number of subscriptions is already challenging, and dealing with complex subscriptions adds another layer of billing complexity. For instance, adopting usage-based billing will require advanced metering and tracking systems.Taxation complexity

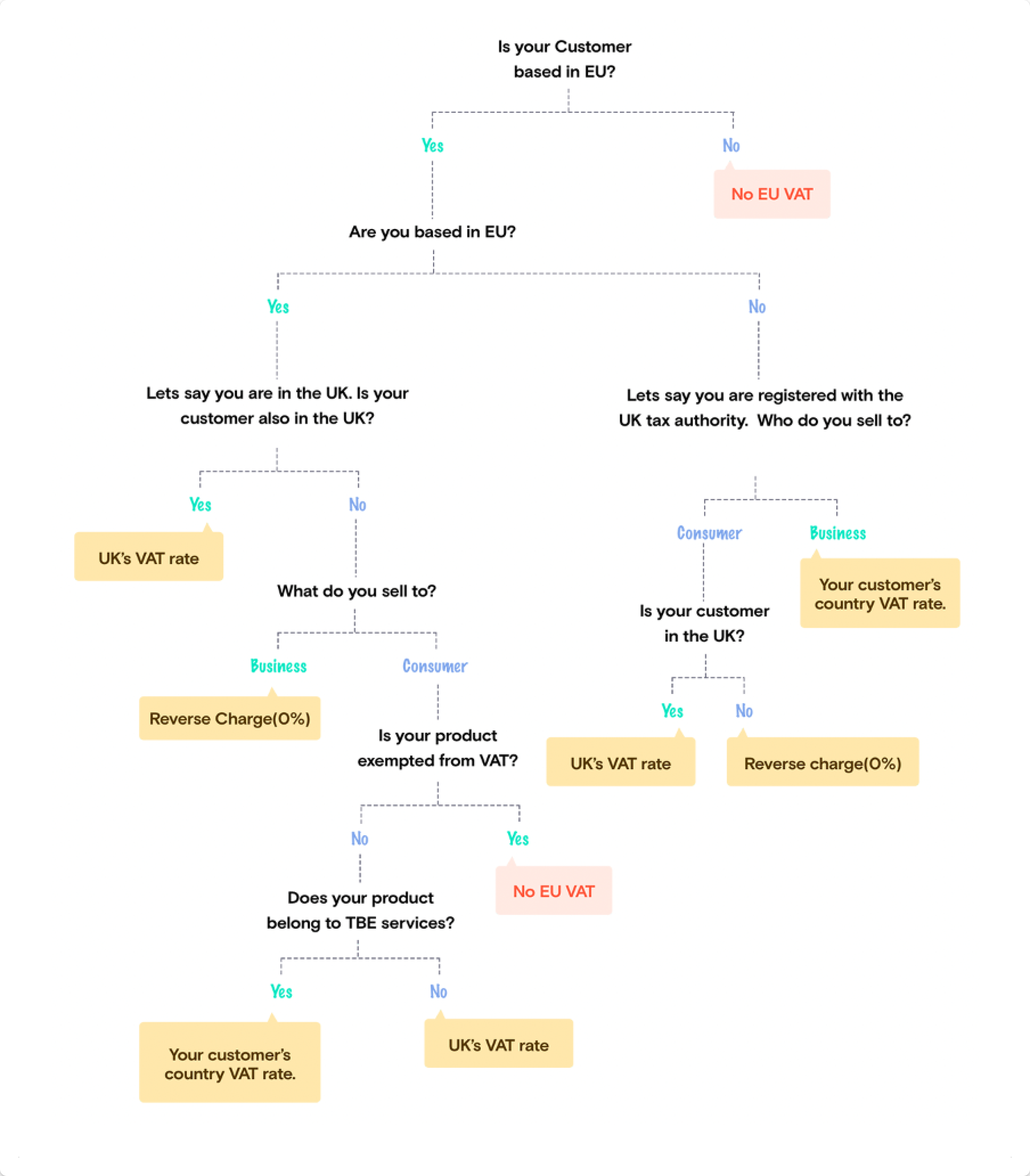

As your business expands globally, dealing with taxes becomes a major factor that increases billing complexity. Taxes can be influenced by several factors: what you’re selling, your location, and where your customers are. Each location has its own tax regulations, so it’s crucial to comply with them everywhere you do business. For instance, consider a European company trying to figure out how to apply VAT (courtesy of Chargebee).

Payment intervals management

The challenge of billing complexity becomes particularly evident when you delve into date management. Imagine a scenario in which a company offers:- a platform access fee charged annually

- a metered product charged every month

- an onboarding fee charged once

- a 3-month free trial for each pricing plan, etc.

Custom pricing

Companies of all sizes often need to go beyond standard pricing. Custom pricing is vital in particular situations, allowing them to adjust their pricing plans to match the unique needs of each customer. This goes from special contracts for Enterprise deals to tailored packages for specific needs. However, managing these custom pricing arrangements with an in-house billing system can be challenging in the long run. This is where a flexible billing system becomes crucial. It should adapt to the diverse pricing needs of each client or situation, making it easier to manage custom pricing, maintain good customer relationships, and increase revenue over time.Multi-currency transactions

Operating in a global market means dealing with multiple currencies. Converting and reconciling transactions in different currencies requires meticulous attention to detail and when you’re building your billing solution it’s very hard to follow up manually. For instance, consider a software company based in the U.S. that sells licenses to customers in Europe. The billing system must convert the sale amount from euros to dollars, accounting for any fluctuations in the exchange rate. On that same subject, it’s also imperative to have aggregated metrics that take into account operations in various countries and currencies and gain a comprehensive understanding of the financial health of your business. These aggregated metrics, such as ARR (Annual Recurring Revenue) on a global dashboard, provide a holistic view of the company’s performance. This not only ensures accurate financial reporting but also supports the generation of globally aggregated metrics that help in strategic decision-making. These dashboards may well be built in-house, but they’re hard to keep afloat over time when your billing system is evolving and has been built from scratch.The challenge of dunning

Dunning is the process of dealing with payments that didn’t go through from customers. It makes billing more complicated for a couple of reasons:- Automatic retries without manual intervention: When a payment fails, you need to give it another shot without needing to remember to do so yourself. Having an automated system that can detect these payment issues and try again is crucial; otherwise, it can become a real headache.

- Effective customer communication: When a customer’s payment fails, you have to let them know in the right way. It’s a delicate balance between informing them about the problem and ensuring they still have a positive experience. That’s why having an emailing system built into your billing process is helpful; trying to manage it manually can be quite challenging.

- Entitlements for service access: Additionally, there’s a need for app logic that handles entitlements, which determine access to the service. Managing these entitlements to restrict access when payments fail adds another layer of complexity to the dunning process.